oregon tax payment system

The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and income taxes. Washington County is one of these local governments that receives property tax revenues of.

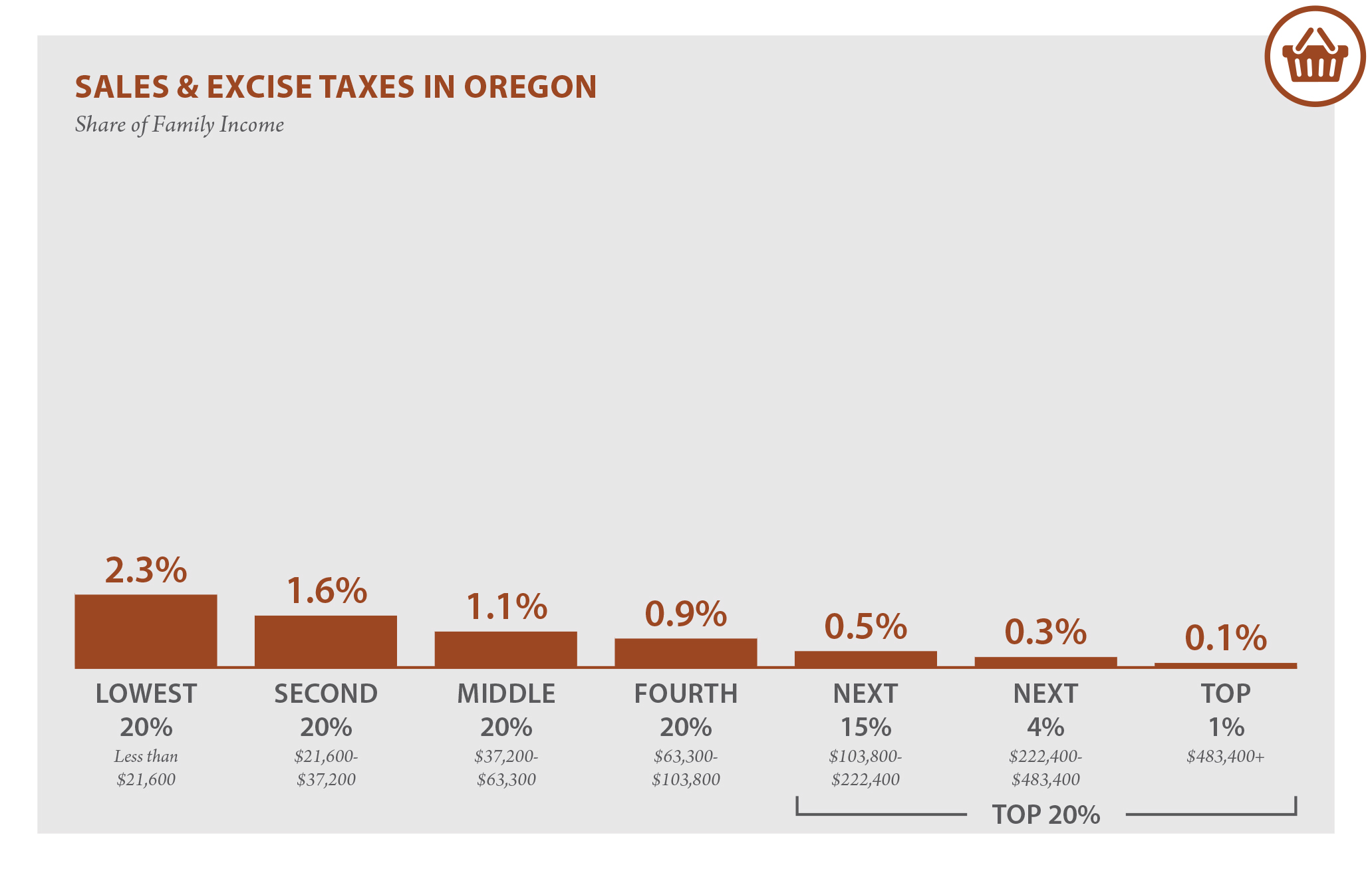

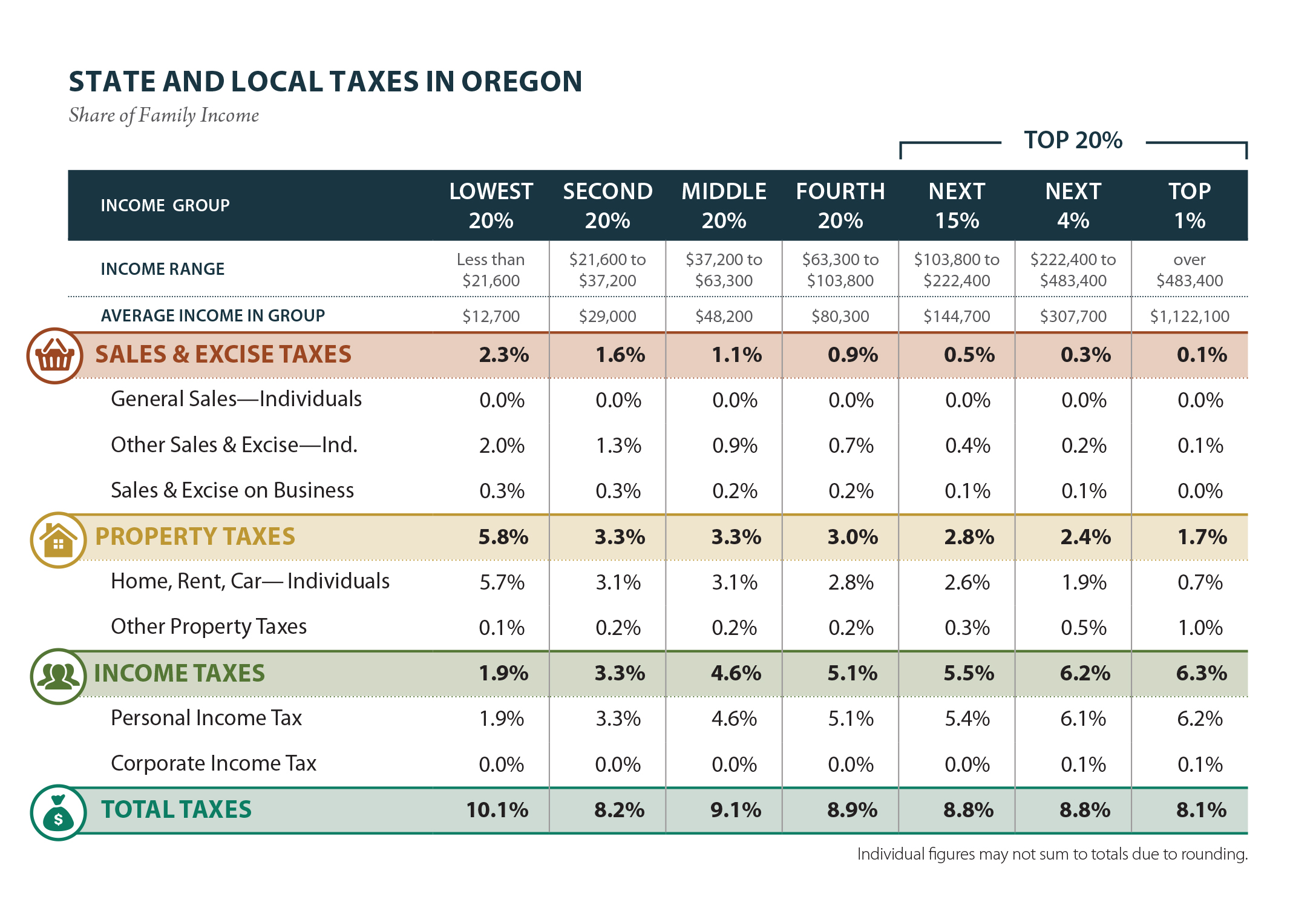

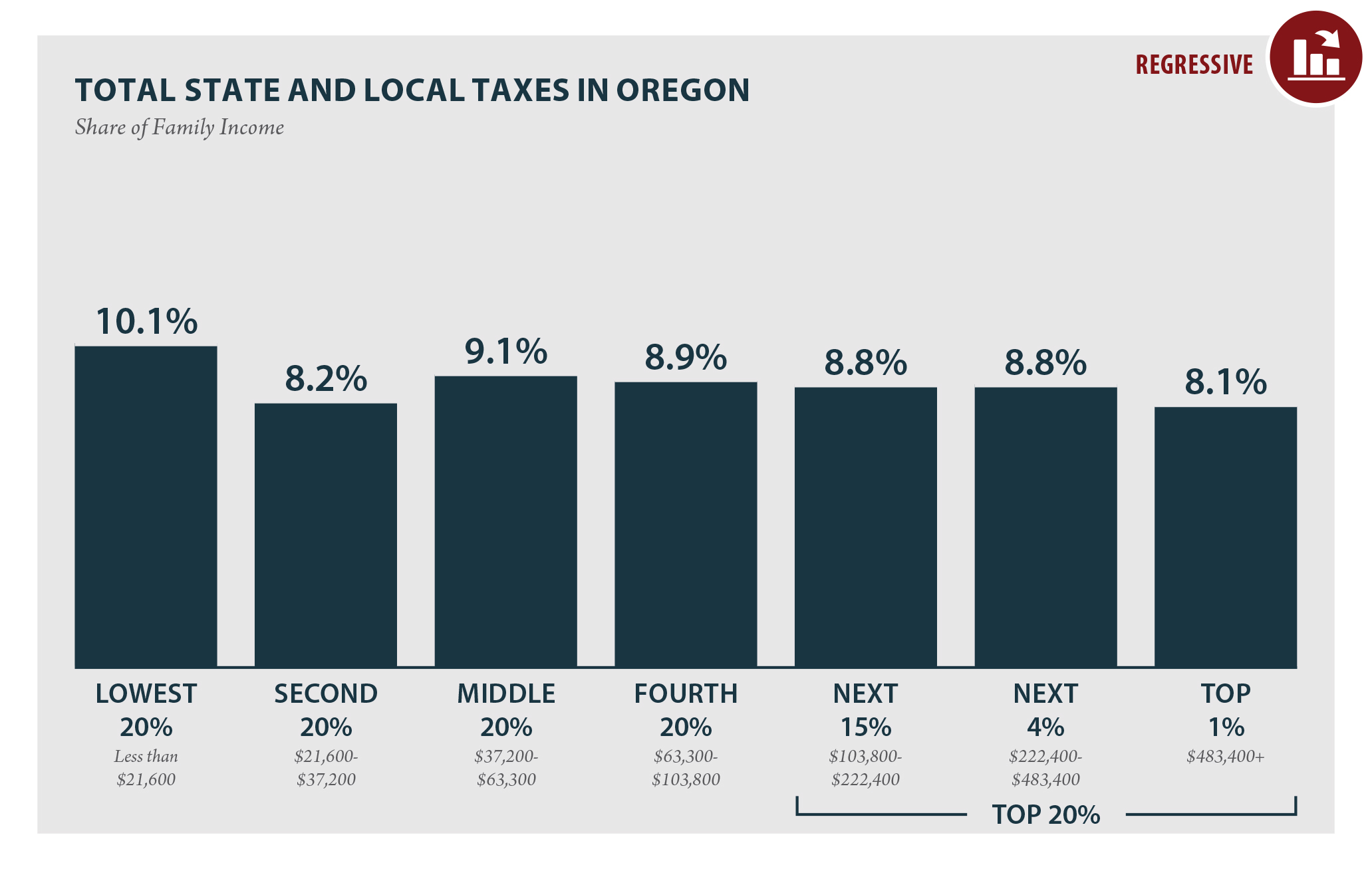

Oregon Who Pays 6th Edition Itep

You can also use the worksheet on Oregon Form 40-EXT Complete the tax payment worksheet below to determine if you owe Oregon tax for 2019.

. Oregon levies a progressive state income tax system with one of the highest top rates in the US at 990. To electronically pay state payroll taxes including the WBF assessment by electronic funds transfer EFT use the Oregon Department of Revenues self-service site Revenue Online. Call us at 503 945-8200 to discuss your debt and options.

Any questions you have about the payment systems will need to be directed to them. Special Oregon Sch P. Each states tax code is a multifaceted system with many moving parts and Oregon is no exception.

These benefits are funded by State Unemployment Tax Act SUTA payroll taxes paid by employers as well as reimbursements from governmental and non-profit employers. Your browser appears to have cookies disabled. If you have any questions or problems with this system please call our EFT HelpMessage Line at 503-947-2017 or visit our EFT Questions and Answers.

File your tax return anyway to avoid penalties. EFT Questions and Answers. Pay the two thirds payment amount on or before November 15 and receive a 2 discount on the amount of current year tax paid.

Pay the Full Payment amount on or before November 15 and receive a 3 discount on the current years tax amount. The new system will support combined payroll reporting. We offer payment plans up to 36 months.

10 of unpaid tax liability. You may pay directly from your checking or savings account or by creditdebit card. It consists of four income tax brackets with rates increasing from 475 to a top rate of 99.

There is no fee when paying with. 10 of unpaid tax liability. We found that English is the preferred language on Oregoneft pages.

The links below have been provided for your convenience. The first step towards understanding Oregons tax code is knowing the basics. Oregon was one of the first Western states to adopt a state income tax enacting its current tax in 1930.

Oregon Tax Payment System Oregon Department of Revenue. How does Oregon rank. From Jesus to Adam Smith there is wide agreement that a fair tax system is one based on the ability to pay asking for a bigger share of a rich persons income than a poor persons.

Thats called a progressive tax system. Be advised that this payment application has been recently updated. PENALTIES AND INTEREST FOR LATE PAYMENTS.

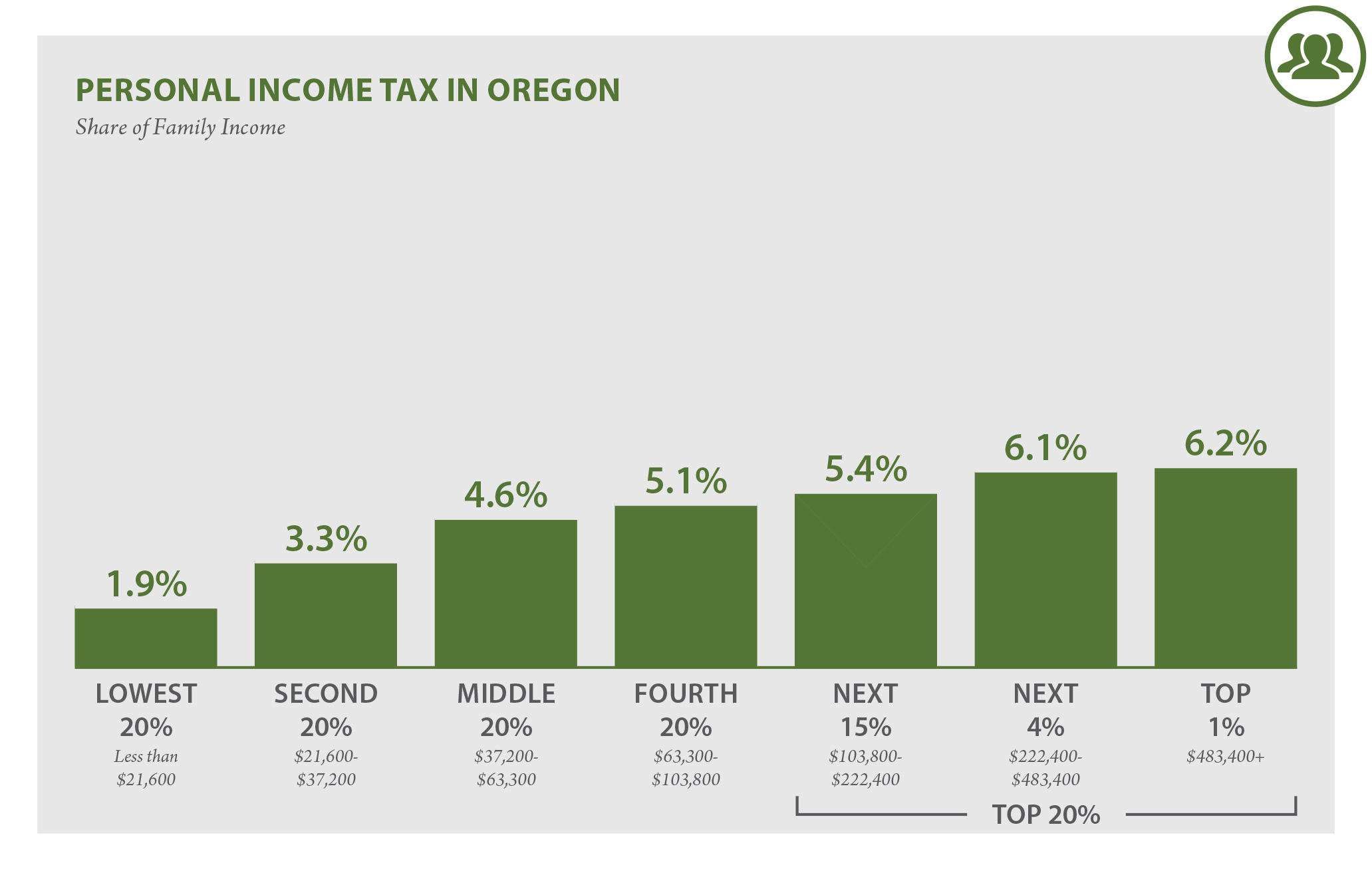

Regular unemployment insurance UI benefits are paid to eligible people who are unemployed or have had their hours reduced through no fault of their own. Oregons personal income tax is progressive but mildly so. Cookies are required to use this site.

Oregon Tax Payment System Oregon Department of Revenue. Oregon Tax Payment System. Residents of the greater Portland metro area also have to pay a tax to help fund the TriMet transportation system.

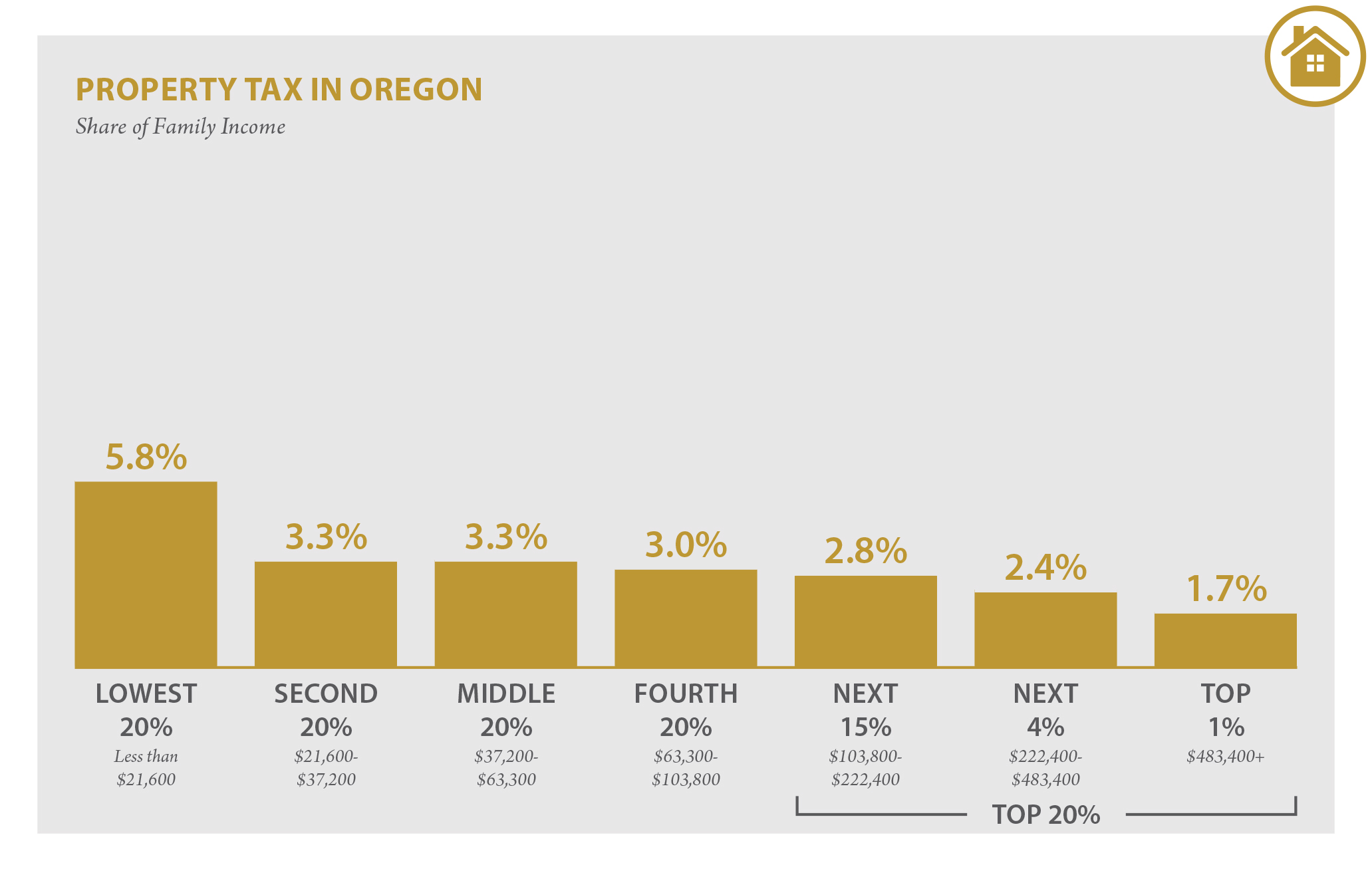

Pay the two thirds payment amount on or before November 15 and receive a 2 discount on the amount of current year tax paid. EFT Questions and Answers. Oregons property tax system represents one of the most important sources of revenue for local governments.

Instructions for personal income and business tax tax forms payment options and tax account look up. Everything you need to file and pay your Oregon taxes. Payments can be made using the Department of Revenues site Revenue Online httpsrevenueonlinedororegongovtap_.

OPRS is a reporting system only. You have successfully logged out of the Oregon Department of Revenue Tax Payment System. It is not a payment system.

The Beaver State also has no sales taxes and below-average property taxes. Late filings are subject to civil penalties of 500 per day minimum and up to 10000 maximum ORS 731988 Civil penalties. Oregons personal income tax is mildly progressive.

The payment system is managed by Department of Revenue. Pay what you can by the due date of the return. In Oregon property taxes help support police fire protection education and other public services provided by local taxing districts such as cities counties and schools.

You have been successfully logged out. Overview of Oregon Taxes. UI Payroll Taxes.

The entire tax system is not. The final one-third payment is due by May 15. Including Unemployment Insurance tax and Paid Family and Medical Leave Insurance PFMLI contributions Workers Benefit Fund WBF State Tax.

Be advised that this payment application has been recently updated. Below we have highlighted a number of tax rates ranks and measures detailing Oregons income tax business tax sales tax and property tax systems. Frances Online will replace the Oregon Payroll Reporting System OPRS and the Employer Account Access EAA portal beginning with the third quarter filing in 2022.

The Oregon Tax Payment System uses the ACH debit method to make an Electronic Funds Transfer EFT to the state of Oregon for combined payroll taxes or corporation excise and income taxes. You can make ACH debit payments through this system at any time with or. Pay your taxes online at Oregon Department of Revenue.

You may now close this window.

Gop Tax Bill Win A Big Loss For Berea College College Berea College Berea Open Source Code

Oregon Who Pays 6th Edition Itep

Oregon Taxpayers Will Receive Kicker Rebate On 2021 Tax Returns Thanks To 1 9 Billion Surplus Local Kdrv Com

Oregon Who Pays 6th Edition Itep

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

Where S My Oregon State Tax Refund Taxact Blog

State Of Oregon Blue Book Government Finance State Government

Oregon Judicial Department Tax Court Opinions Tax Court Opinions State Of Oregon

Oregon Bottle Deposit Value To Double In April 2017 Soda Tax Bottle Beer Bottle

![]()

Oregon Judicial Department Ojd Courts Epay Online Services State Of Oregon

Oregon Who Pays 6th Edition Itep

State Of Oregon Oregon Department Of Revenue Payments

State Of Oregon Blue Book Government Finance Taxes

What Is The Oregon Transit Tax How To File More

Oregon S Crazy Income Tax Brackets Editorial Oregonlive Com

Benefits Of Hr Payroll Management Singapore Payroll Software Hr Management Payroll

Wage Inequality In Oregon A Wide Gap Article Display Content Qualityinfo Inequality Lorenz Curve Seasonal Jobs